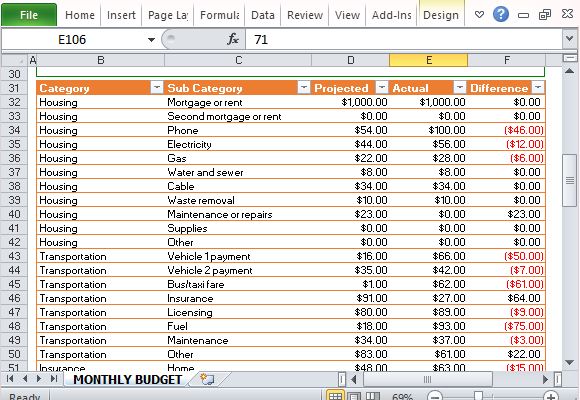

While it is not the most feature-packed budgeting tool in the world, it was created as a way for people to get motivated and started on their budgeting goals, then eventually move onto more intricate budget-planning tools. We have created a free, basic, budget template for people who want to start budgeting their personal finances on a month-to-month basis. The Budget Calculator evaluates the components of a personal budget and highlights which specific areas need improvement.

Millennia-old religious teachings, countless online resources, and thousands of financial advisors over time have echoed the principle of living within your means. Successful budgeting usually involves having a detailed personal budget and adhering to it.

#HOUSEHOLD BUDGET ITEMS HOW TO#

How to Budgetīudgeting can generally be summed up by two things: living within your means and planning for the future. They all have their pros and cons, but the one that works best is the one that budgeteers will bother sticking with as best as they can.

#HOUSEHOLD BUDGET ITEMS SOFTWARE#

Modern technology has paved the way for many different budgeting software and apps.

#HOUSEHOLD BUDGET ITEMS FREE#

While some people may prefer our budget calculator or our free budget template, others may prefer different methods. There are many different reasons why people create budgets, and even more ways to go about doing so.

Generally, budgets are created to reach certain financial goals, such as paying off several credit cards, reaching a certain savings goal, or getting income and expenses back on track. Related Debt Ratio Calculator | Credit Card Calculator | College Cost CalculatorĪ budget is an estimate and planning of income and expenditure, and commonly refers to a methodical plan to spend money a certain way. Including tickets, gym membership, etc. savings, CD, house or major purchase, etc. copay, uncovered doctor visit or drugs, etc. laundry, barber, beauty, alcohol, tobacco, etc. the recurring part to payback balance only electricity, gas, water, phone, cable, heating. repair, landscape, cleaning, furniture, appliance. home owner, renters, home warranty, etc. gift, alimony, child support, tax return. interest, capital gain, dividend, rental income.

0 kommentar(er)

0 kommentar(er)